Introduction:

The last few years have seen blockchain technology and crypto spread across various domains and industries. These days, many businesses, including Silicon Valley giants like Google and Facebook, are eager to incorporate crypto into their existing models.

Cryptocurrencies have enabled businesses to revolutionize the way they currently carry transactions. Furthermore, it has also empowered entrepreneurs to take the lead. That will help them transform and manifest their robust and innovative ideas into startups in their respective domains.

The Growth of Crypto Startup Market

On October 11, 2021, NASDAQ published a report stating that Google has partnered with Bakkt, a crypto marketplace, and Bitcoin. Meanwhile, Facebook is backing Diem, a cryptocurrency project formerly known as Libra.

According to one report, over 85 million crypto wallets are registered worldwide. And the good news is that this global blockchain/crypto market will continue to grow. Experts predict that the market size of crypto will climb to over $94.0 billion by 2027 at a CAGR of approx. 66.2% from 2022 to 2027.

Further, our detailed blockchain and cryptocurrency reality check states that since blockchain and cryptocurrency are rapidly evolving, the future technology and trends will show how they affect NFTs, IoT, and Metaverse trends.

So, if you wonder which crypto startups in 2024 are worth looking into, this post is for you. You will learn about the best ten Crypto startups that are currently impacting the blockchain universe.

Top 7 Crypto Startups in 2024

Here are 10 of the best crypto startups you can look into, especially if you are a crypto trader or investor. Exploring what they do and learning about their services may give you an early-bird advantage to get in and reap exponential benefits in years to come. So, without further ado, let us dive right in!

Chainalysis

Year Founded: 2014

Another up-and-coming American crypto startup in 2024 hails from New York, whose current search growth status is regular, with a 5-year search growth forecast at 1087%. In the Series E funding phase, Chainalysis has already accumulated an impressive $366.6 million in funding. According to Crunchbase, the company currently has the backing of approximately 27 investors.

Chainalysis promises to create a transparent platform for a worldwide economy. They have done so by building a digital economy on blockchain. This enables governments, banks, and businesses to come to a common understanding of how people tend to use cryptocurrencies. In simpler words, Chainalysis plans to bring some accountability and law to the untamable beast of blockchain.

They have also developed a compliance, investigation, and risk management tool to help solve criminal cases in the crypto world. So far, Chainalysis has sold to numerous companies in more than 60 countries.

Fumbi

Year Founded: 2018

A Slovakian crypto-player makes this list because of its extremely promising 5-year search growth forecast at 1100%. Fumbi has its head office in Bratislava, Slovakia, with a regular search growth status.

This cryptocurrency trading platform replaces collection investment schemes. The users on Fumbi will be able to own their crypto coins directly.

The startup in 2023 already has more than 115,000 registered users who can trade in 34 cryptocurrencies. So far, Fumbi has generated an “Early stage VC” funding of $1.8 million since 2018.

Mintable

Year Founded: 2018

Another promising crypto startup in 2024 from Singapore, Mintable, has been around since 2018. This blockchain marketplace has a regular search growth status with a 5-year search growth forecast at 99X+.

So far, it has managed to earn the trust and confidence of 17 investors. It may pique your interest to know that Mintable has attracted the interest of several billionaire entrepreneurs like Mark Cuban. The total Series A funding amount for Mintable stands at an impressive $13 million.

Mintable is aiming to capitalize on NFTs. The platform wants to ride the NFT boom as it offers a marketplace for its users to make and sell an NFT. Although NFTs can be a great investment, they have some risks. However, you can avoid those common NFT scams with safety tips.

Pastel Network

Year Founded: 2018

Another New Yorker on the crypto block, Pastel Network, is a startup that began its journey in 2018. The digital platform has a regular search growth status.

Pastel Network offers a decentralized peer-to-peer platform allowing its users to register, collect, and trade their digital assets.

So far, Pastel Network has garnered a massive seed funding of $5 million. Promising news for new investors looking for an opportunity to enter cryptocurrency trading is that Pastel Network generated an estimated annual revenue of $1.3 million.

Sorare

Year Founded: 2018

If you want to invest in or trade on European crypto startups in 2024, Sorare is for you. This startup hails from Saint Mande, France. It is a one-of-its-kind fantasy soccer blockchain-powered platform that has been around since 2018.

It currently has a regular search growth status with a forecast of 5-year growth of more than 99x. You can gauge the success of Sorare by the Series B funding it received. So far, this startup has already stacked up a budget of $739.4 million. There are currently 33 investors backing this crypto-based soccer gaming platform.

As a user, you can play fantasy soccer on Sorare by using its gaming arena. Furthermore, this platform also serves as a marketplace for its users to trade digital player cards. You can trade your limited editions of players’ digital cards. Sorare has an official license and authorization to issue digital player cards to 142 soccer clubs.

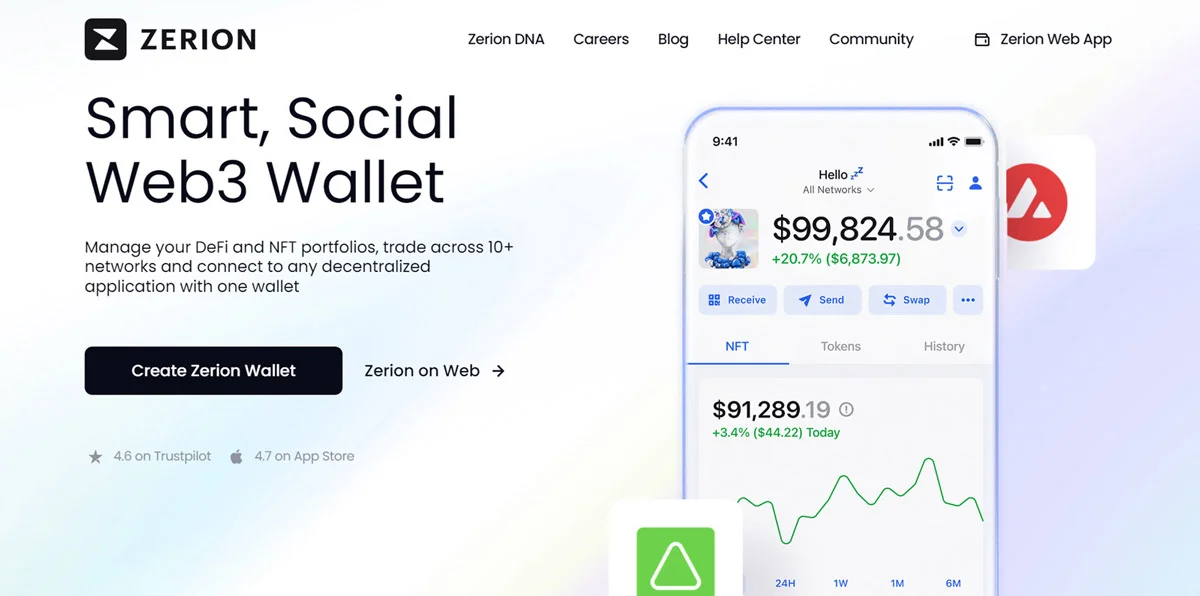

Zerion

Year Founded: 2016

This one is an all-American crypto startup that hails from San Francisco, California. The company appeared on the blockchain landscape back in 2016 with a regular search growth status. The current 5-year search growth forecast for Zerion is an estimated 1475%.

During series A of its funding, Zerion has already generated a massive amount of $10.2 million in funding. This crypto startup in 2023 has already got the backing of 23 investors and reported three employees running the entire show.

Zerion allows investors to invest in multiple DeFi options and projects. It also offers convenience to its users by allowing them to receive data on their DeFi projects. Users can track their portfolios, trading them right under a single umbrella. Currently, the Zerion marketplace supports more than 60 DeFi projects and has more than 200,000 active users per month.

These top crypto startups may roar in 2024. They have proven their ability to identify pain points, develop novel solutions, and implement tactics that appeal to both users and investors.

Cryptocurrency and blockchain is a complex industry with several risks involved, and one needs to be equipped with basic knowledge. So, if you want to get a hang of it, you can bank on us. As an industry-leading software development company in the USA, we assist businesses with blockchain and cryptocurrency.

Closing Thoughts

Whether you are a trader or an investor looking for promising crypto startups in 2024, the platforms mentioned above are an excellent place to start. The options are endless, from trading platforms to regulatory solutions and crypto-based gaming arenas. So, pick one that piques your interest.