Fintech combines the words “Financial” and “Technology.” Fintech companies offer financial and banking services to their customers through software. Innovations are driving the adoption of new technologies worldwide. The adoption of online banking is increasingly growing worldwide.

Furthermore, investors are funding Fintech companies as the use of online banking continues, and financial services are spreading across the globe. Fintech Conversational chatbots are also transforming the banking experience for both businesses and consumers.

Trivia about the Fintech Industry

- The Fintech industry’s revenue stands at $186.87 billion in 2023.

- Between 2017 and 2023, the revenue of the Fintech industry has experienced nearly 100% growth.

- In 2023, more than 26,300 fintech startups exist worldwide.

- In 2023, the United States hosts over 10,000 Fintech startups.

- By 2024, experts anticipate the revenue of the Fintech industry will reach $201.91 billion.

- From 2017 to 2024, experts project a CAGR growth rate of 11.7% for the Fintech industry.

How Did Fintech Startups Change the Traditional Financial Industry?

Fintech startups have radically transformed the traditional financial industry, causing disruption. They have shifted financial services from the domain of salespeople and desktop computers to mobile platforms, challenging the dominance of established financial institutions.

For instance, Robinhood, a mobile-exclusive trading platform, revolutionized the industry by eliminating trading fees. Similarly, Prosper Marketplace offers peer-to-peer lending without any service charges.

Well-established startups like Lendio, Accion, Kabbage, and Funding Circle provide accessible platforms for obtaining working capital. In 2018, online insurance startup Oscar secured a $165 million funding round, reflecting the common trend of substantial funding for Fintech startups globally.

In addition, fintech companies are also taking control of the e-commerce world. Fintech startups are providing custom services to online sellers according to their needs and budgets. Hence, the launch of fintech companies has a profound impact on the growth of e-commerce development services.

Top 10 Fintech Startups 2021 to 2024

The fintech startup culture is experiencing rapid growth, fueled by the expanding scope of this sector. Aspiring entrepreneurs looking to break into the fintech market can find valuable templates in the success stories of the most popular fintech startups.

From handling payment transactions to providing financial services, the top fintech companies and startups from 2021 to 2024 are shaping the industry. Examining various fintech startups can provide insights into the opportunities for innovation within the fintech ecosystem.

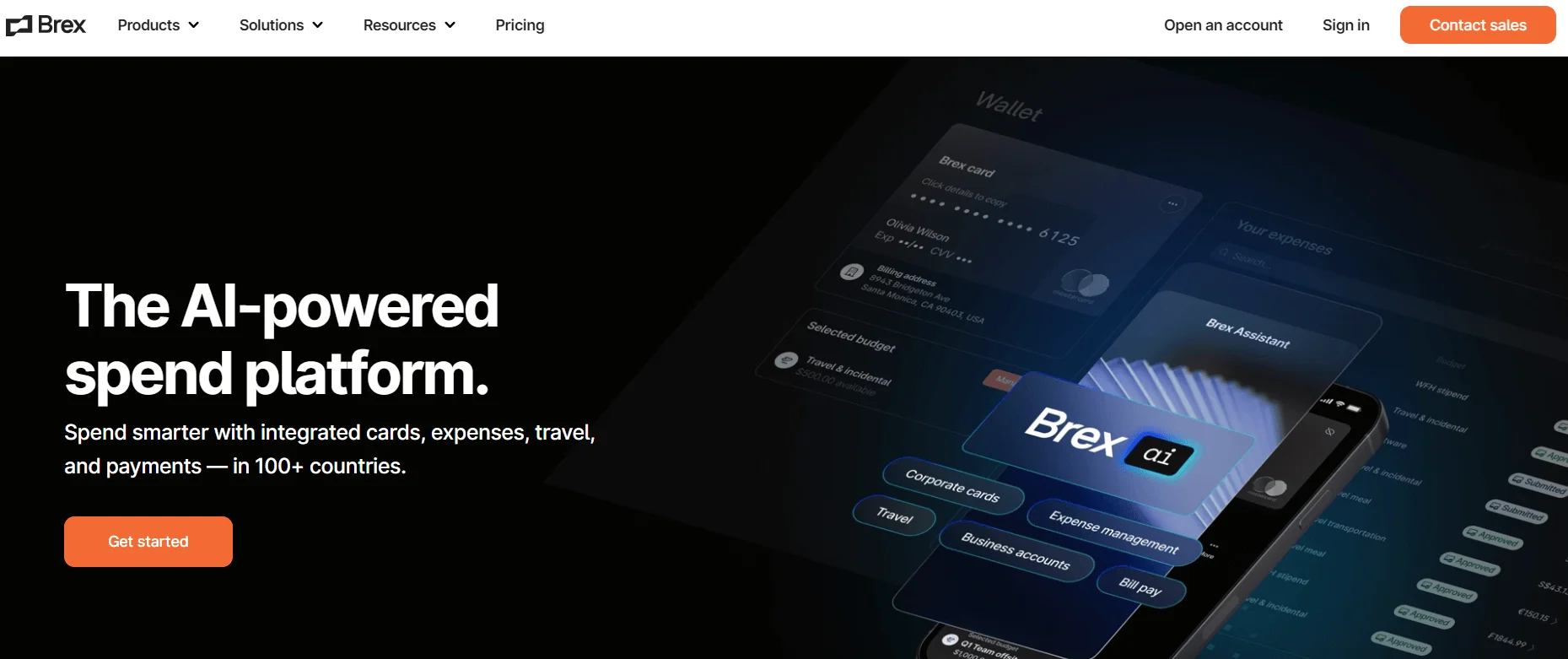

- Year founded: 2017

- Location: San Francisco, California

- Funding: $1.5B (Series D)

- CEO: Henrique Dubugras

- 5-year search growth: 280%

Brex’s online banking platform primarily targets the B2B market, strongly focusing on high-growth startups. They offer a range of products, including corporate credit cards, cash management accounts, and integrated analytics tools.

Coin List

- Year founded: 2017

- Location: San Francisco, California

- Funding: $119.2M (Series A)

- CEO: Graham Jenkin

- 5-year search growth: 3900%

The surge in the global popularity of cryptocurrency has given rise to several thrilling fintech startups focused on aiding ordinary individuals in buying, storing, and using cryptocurrency in a user-friendly way.

Over 5 million crypto consumers utilize CoinList to gain access to tokens before their listing goes up on more widely recognized exchanges.

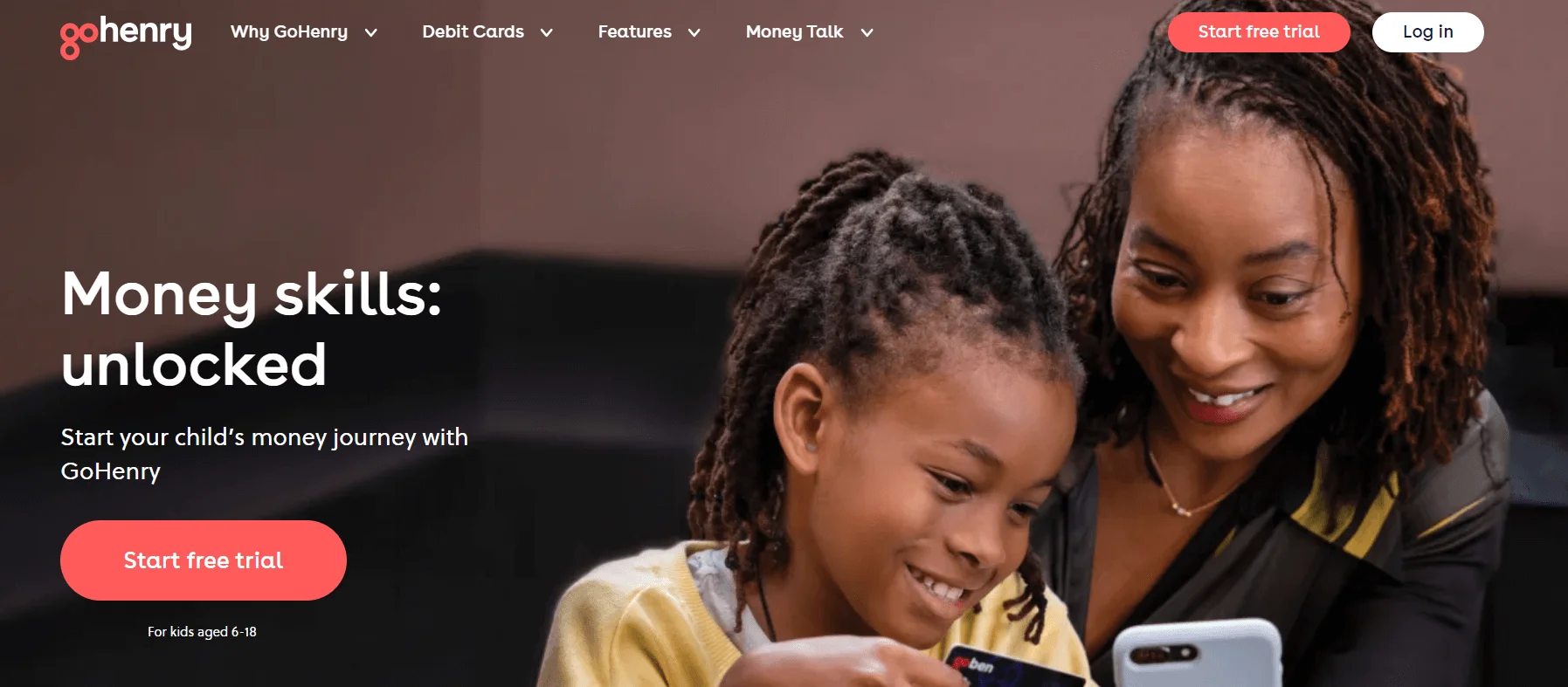

GoHenry

- Year founded: 2012

- Location: London, UK

- Funding: $121.2M (Series B)

- CEO: Alex Zivoder

- 5-year search growth: 557%

Gohenry operates as a money management platform that educates young people on financial management. Children can initiate transactions through prepaid debit cards, which parents have control over. The company reports that Gohenry has more than 1,000,000 paying customers.

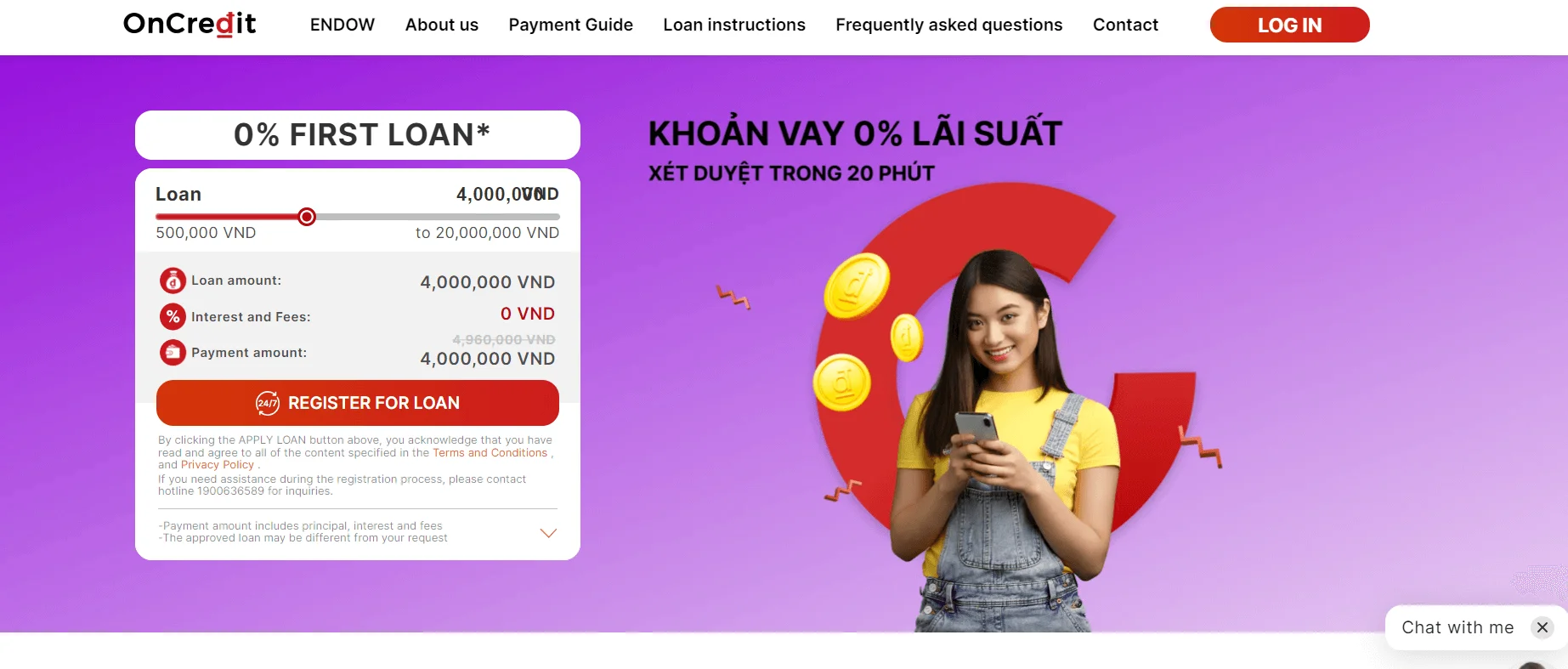

OnCredit

- Year founded: 2019

- Location: Ho Chi Minh, Vietnam

- Funding: Undisclosed

- CEO: Roman Katerynchyk

- 5-year search growth: 4900%

OnCredit operates as a digital lending platform offering short-term loans to consumers and small businesses in emerging markets. It utilizes advanced data analytics and machine learning algorithms to evaluate creditworthiness and tailor loan products to individual borrowers, facilitating swift and efficient access to credit.

PayDo

- Year founded: 2017

- Location: London, England

- Funding: $990K (Seed)

- CEO: Donato Vadruccio

- 5-year search growth: 488%

This fintech company delivers an array of payment solutions and merchant services to businesses. It extends multi-currency accounts, online payment processing, payment gateway, and card-acquiring services to businesses of all sizes.

PayDo’s extensive set of services empowers merchants to securely accept payments, oversee transactions, and broaden their global market presence. This makes it a valuable partner for businesses aiming to optimize payment operations.

Rocket Money

- Year founded: 2015

- Location: Silver Spring, Maryland

- Funding: $84M (Series D)

- CEO: Haroon Mokhtarzada

- 5-year search growth: 814%

Many individuals find themselves overwhelmed by the sheer volume of bills stemming from streaming services, apps, subscriptions, and meal services.

Rocket Money simplifies the process by effectively tracking your bills and simplifying the cancellation process. The company states that 2 million customers utilize Truebill and have collectively saved over $100 million on avoidable subscription expenses.

Stripe

- Year founded: 2010

- Funding: $8.7B (Grant)

- Location: San Francisco, California

- CEO: Patrick Collison

- 5-year search growth: 76%

Stripe, in rapid progression, has achieved the status of being one of the most valuable private companies in any industry. It now serves as an online payment processor on 1.9 million diverse websites, catering to businesses that span from small startups to large enterprise brands.

In December 2021, Stripe bolstered its capabilities by acquiring the application software Open Channel, aiming to enhance their ecosystem integrations.

Vivid Money

- Year founded: 2020

- Location: Berlin, Germany

- Funding: $188.2M (Series C)

- CEO: Céline Singleton

- 5-year search growth: 2600%

Vivid Money provides a financial and mobile banking application solution. Their platform comprises high-interest savings accounts, multi-currency access, and reporting features. They recently broadened the platform by incorporating brokerage capabilities, allowing users to buy or sell stocks and ETFs.

Additionally, they present attractive cashback options for spending and storing money within their platform.

Wagepay

- Year founded: 2020

- Location: Brisbane, Australia

- Funding: $6.7M (Debt Financing)

- CEO: Tony Chan

- 5-year search growth: 400%

Wagepay, a fintech startup, delivers an earned wage access solution designed to enable employees to access wages they have made but remain unpaid.

The company collaborates with employers to provide this service, assisting employees in avoiding payday loans and overdraft fees. Wagepay additionally supplies employers with real-time data on employee wages and spending patterns.

Z1 Conta

- Year founded: 2020

- Location: São Paulo, Brazil

- Funding: $12.5M (Series A)

- CEO: João Pedro Thompson

- 5-year search growth: 99X+

Z1 Conta offers a financial application designed to provide digital banking services specifically catered to teenagers and young adults. Their application integrates financial education, gamification, and digital banking features to assist users in managing and spending their money responsibly, all without hidden fees.

The goal is to provide a user-friendly platform that fosters financial literacy and aids young individuals in developing sound money management habits.

What Does The Future Hold?

Here is a blockchain and cryptocurrency reality check: security risks are always a concern for industries highly connected with money. That’s where fintech companies may help. Fintech companies are sure to launch multiple highly secure solutions that require numerous authentication forms that almost exclude all forms of fraud.

In addition, the future looks promising for people who want to explore how to make and sell an NFT. NFTs and DeFi were initially launched as separate applications, but it soon became apparent that NFTs might work well as a tool for DeFi. Fintech companies may employ NFTs to their advantage, according to numerous experts, even though there are still certain obstacles to overcome and things that need to be streamlined.

Even if your business does not operate within the fintech industry, developments in this field can significantly impact your operations. Staying informed about the most popular Fintech trends, including DeFi and blockchain, RegTech, P2P lending, and artificial intelligence, is also crucial. For more information, get in touch with the best software development company in USA.

FAQs

How Do FinTech Companies Generate Revenue?

Such companies earn money in different ways, such as peer-to-peer lending, e-wallets, crowdfunding, crypto trading, subscriptions, APIs, advertising, and rob advising.

How Do Fintech Companies Play Their Roles?

Fintech companies usually serve as industry disruptors. These companies leverage technology to transform how consumers engage with the financial sector.

Name A Few Fintech Companies.

Popular examples include mobile banking companies like Venmo/Cash App, automated portfolio managers like Wealthfront/Betterment, and trading platforms such as Robinhood.